Financial planning is a complex and integrated activity that is often simplified in an attempt to make it more accessible. When we look at it as a lifestyle rather than an annual exercise, it’s easier to begin to engage with our financial plan in a more meaningful level. Saving and investing are two disciplines that are core to the foundations of a solid financial plan, and for simplicity sake, they are often seen as the same […]

Continue readingMore TagAuthor: anthonyb@timslatter.com

How mindfulness helps our money

How much time do you waste trying to solve problems that haven’t happened yet? Many of us fixate on problems that might happen tomorrow, next week or several years in the future, and this is not what life and financial planning are about. Getting stuck in the future at the cost of living life to its fullest today is precisely what we’re trying to avoid! This is why we talk so much about being mindful. Dr […]

Continue readingMore TagNeed a little grounding?

Have you ever gone for a walk in the garden without shoes on? Remember what it felt like, as a kid, to come home from school – slip out of tight school shoes and walk barefoot? Whether it was on comfy rugs, soft sea-sand or lush grass, the sensation often felt so good because we were grounding ourselves. A quick Google search will tell us that there’s a lot more happening when we walk barefoot. The […]

Continue readingMore TagBecome a better networker

As our world becomes increasingly digitised, personal skills will become more valuable. Many salespeople call these the soft-skills and realise that the old-school hard-sell-skills are no longer as effective. People are less likely to be blown away by some widget and far more likely to remember the way that you’ve made them feel. It doesn’t really matter if you’re in sales or not, or even in your own business. Networking is a skill that helps us […]

Continue readingMore TagBuilding wealth, one brick at a time

The root of our wealth is not in our income or our spending; it’s in our behaviour. Our habits make us wealthy, not the markets. Some have said that sound financial management comes down to spending less than we earn – but whilst this adage holds merit, it’s a lot more complicated in practice. It’s complicated because people are complicated. It’s not helpful to tell someone who is already relying on credit to get through the […]

Continue readingMore TagPlanning vs Coaching

Regardless of what words we want to put to our journey with our money, there are a few realities that we need to face. First – everything we do is linked to money, whether we pay for it ourselves or rely on a benefactor. Second – some of our wealth-generation depends on luck and circumstance, but most of it depends on our ability to intentionally earn an income and manage the money we have. Third – […]

Continue readingMore TagWhat a better financial plan could look like

It’s easy to think about a financial plan and consider the elements that typically go into it. For instance, we could picture a plan that consists of a retirement savings product, life and health insurance, investment portfolios, and maybe a few things like trusts, wills and estate plans. Or, we could think about what a financial plan can help us avoid, and help us achieve. When we think of our financial plan in terms of the […]

Continue readingMore TagWhat’s changed in your life?

WHERE TRUE FINANCIAL PLANNING STARTS One of the best ways to make any constructive change or difference in the direction of our lives is to take a moment to observe what’s currently going on. Life whizzes by so quickly that if we don’t check in with ourselves, we will find it hard to observe and articulate what has changed. Financial planning, if done right, should start in the same place. Rather than beginning a financial planning […]

Continue readingMore TagThank you, money

Some people say that magic isn’t real, but what about the first magic words we’re all taught to say? No – not “abracadabra” or “zimzalabim”, although those are great words. Abracadabra is thought to come from the Aramaic phrase “avra kehdabra”, meaning “I will create as I speak”, and zimzalabim comes from the mythological tricksters, Zim Zala and Bim. But, our most basic and formative levels of social etiquette (getting people to do what we want […]

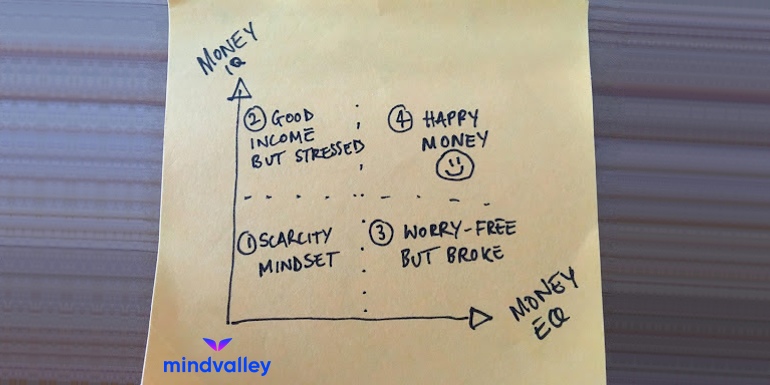

Continue readingMore TagBuilding your Money IQ… and EQ!

Would you consider yourself to be financially intelligent? Depending on how you answer that, here’s another tough question: how much do you trust yourself to manage your own finances? Often we find that after answering the second question, clients want to go back and reanswer the first! And, that’s okay. As Ken Honda suggests, there’s more than one type of financial intelligence, and we can work on both to be happy and prosperous. Honda, Japan’s no. […]

Continue readingMore Tag