HOW IT INFLUENCES YOUR FINANCIAL PLANNING Money is universal. But our relationship with it? That’s deeply personal, shaped by a multitude of factors ranging from age and life experience to cultural influences and socioeconomic status. Remember, it’s not just about the numbers. It’s also about who we are and where we come from. Understanding how these factors influence our financial behaviours can help us break patterns that no longer serve us, and build healthier habits that […]

Continue readingCategory: MARKET

Your brain and your money

HOW BIOLOGY SHAPES YOUR FINANCIAL PLANNING It’s easy to think of financial decision-making as purely rational. After all, money is all about numbers, right? But what if the way we handle money has as much to do with biology as it does with strategy? What if our brains and bodies are constantly influencing our financial behaviours in ways we rarely even notice? Understanding the neurological and physiological factors at play can help us become more intentional […]

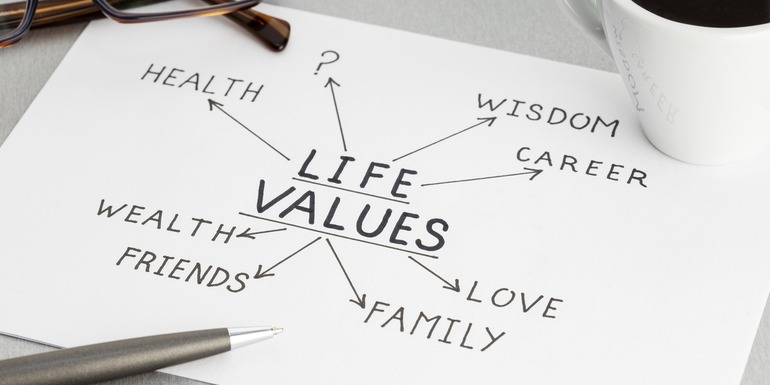

Continue readingPersonal values and goals

HOW THEY INFLUENCE YOUR FINANCIAL PLANNING What would your financial life look like if it truly reflected your values? It’s a question worth asking because, when it comes down to it, money is just a tool. And like any tool, its value lies in how you use it and the purpose it serves. But how do we figure out what our values truly are? It starts with reflection. What brings genuine fulfillment and joy into your […]

Continue readingThe law of diminishing returns

We live in a world where more is often seen as better: more money, more investments, more security, more financial strategies. But what if there comes a point where adding more doesn’t necessarily add value? The law of diminishing returns suggests that beyond a certain point, additional effort or resources result in smaller and smaller benefits. And this principle applies directly to financial planning. Investing At the start of your investing journey, each rand, dollar, pound […]

Continue readingChoosing a trusted partnership

At first glance, it seems obvious why someone would seek out a financial adviser or planner; to make smarter money decisions! But if that were the only reason, personal finance books and online calculators would have made financial planners obsolete long ago. The reality is that the true value of an adviser goes far beyond spreadsheets and portfolio allocations. People don’t just want a guide for their finances; they want a partner in financial decision-making—someone who […]

Continue readingThe holistic approach to life cover

When it comes to life insurance, one of the most common questions people ask is: How much cover do I actually need? While the typical rule of thumb suggests between 10 to 15 times your annual salary, the real answer depends on your unique circumstances, responsibilities, and financial goals. Rather than picking a number out of thin air, let’s take a step back and look at the bigger picture. A well-structured life insurance plan isn’t just […]

Continue readingPredictions, Plans, and the Power of Perspective

If history has taught us anything, it’s that predicting the future—especially when it comes to markets—is an exercise in futility. Every year, analysts, economists, and investment strategists make bold forecasts about where stocks will land, how interest rates will shift, and what geopolitical events will shake the financial world. And every year, those predictions are proven, at best, only partially correct. Market forecasts are like long-range weather predictions. We can analyse trends, observe patterns, and make […]

Continue readingThe cost of trust

Financial advice is about more than just investments and returns—it’s about trust. And one of the most important, yet often overlooked, aspects of that trust is how you pay for your financial advice. It’s a conversation that affects every investor, expat, and retiree, regardless of where they are in the world. Broadly speaking, financial advisers are compensated in one of two ways: commissions or fees. Both have their place in the industry, but each model carries […]

Continue readingIt’s not accidental; it’s intentional.

No one stumbles into wealth by accident. Even those who win the lottery often find themselves broke again within a few years. It’s also not about trying to cut back on your take-out coffee. Financial success isn’t about luck, and it’s not about making one perfect decision that changes everything. It’s about consistent, intentional choices that build toward a future you actually want. Being intentional with your money doesn’t mean obsessing over every transaction or living […]

Continue readingRaise a millionaire

Raising financially responsible children who may one day become the next “Millionaire Next Door” is less about complex financial strategies and more about small, intentional lessons woven into everyday life. It starts with recognising that children learn more from what we do than what we say. If we want them to grow into thoughtful stewards of their wealth, we must first model responsible behaviour ourselves. Showing them how we save, budget, and make spending decisions is […]

Continue reading